Introduction: In the current economic environment when inflation is constantly rising, people’s income is limited and managing household expenses has become more challenging than ever, if you get the news of getting a $5,000 stimulus payment from the government, then it is definitely like a sigh of relief. This new stimulus program, which started in August 2025, has promised to provide relief to millions of Americans.

In this article, we will tell you in a simple but detailed way in completely humanized language how to claim this $5,000 Stimulus, what documents will be required, what is the eligibility, and what mistakes to avoid so that your payment is not stopped in any way. Let’s get started…

$5,000 Stimulus Payment: Why is this payment necessary?

Over the past few years, the US economy has seen many ups and downs – pandemic, unemployment, supply chain disruptions and then rapidly rising inflation. In such a situation, the government has repeatedly tried to provide relief to the public through various federal and state level stimulus payments.

This new $5,000 stimulus payment announced in August 2025 has been brought specifically keeping in mind the low and middle income people. Its purpose is – to stabilize the financial condition of families, help with children’s education, health and living costs, and most importantly – reduce the burden of household expenses.

Who is eligible for this payment?

Now the question comes, is everyone eligible for this stimulus payment? So the answer is – no.

Some prescribed eligibility criteria have been fixed for this, which are as follows:

Income Limit:

- The annual income of a single filer should be less than $75,000.

- The income of a married filing jointly should be less than $150,000.

- Less than $112,500 for Head of Household.

Tax Filing Status:

- You must have filed income tax for the year 2023 or 2024.

- Social Security Number (SSN):

- You must have a valid SSN.

Citizenship or legal residence: It is mandatory to be a US citizen or legal resident alien.

Direct Deposit Details: You must have an active bank account so that the government can make direct payments.

Step-by-Step Guide: How to Claim $5,000 Stimulus?

If you meet the eligibility criteria given above, now know the complete process – step by step, by following which you can get your stimulus payment without any hassle.

Step 1: Review your tax records

The IRS first issues payments to those people whose tax records are updated. If you still have 2023 and 2024 tax forms to file, get them in as quickly as you can. This is the first, and the most important thing for yourself.

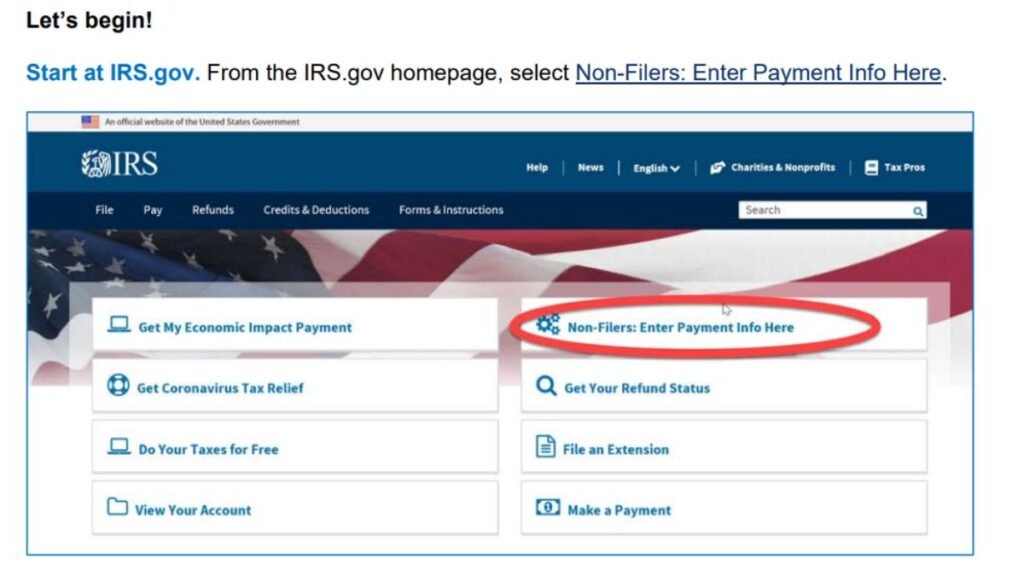

Step 2: Log in to the IRS website

Go to and log in to your account. If you have never logged in before, select the “Create Account” option and fill in your information.

Step 3: Update Direct Deposit information

Visit the IRS website to check your bank account information and make sure it is updated. Be careful that the payment is not transferred to the wrong account number or a closed account.

Step 4: Use the ‘Get My Payment’ tool

The IRS has launched a special tool ‘Get My Payment’ through which you can track the status of your payment. Here you will also get information about when your payment will come and through which mode.

Step 5: Wait for a confirmation email or letter

Once your payment is processed, the IRS sends a notification letter or email to your address with complete details of the payment. Keep it safe.

What mistakes to avoid?

Many times people miss their payment due to small mistakes. So pay special attention to the following things:

- Giving wrong bank account number

- Filling wrong Social Security Number

- Giving false information about income

- Applying from fake websites

- Applying more than once

- Any of these mistakes can either delay or completely reject your stimulus payment.

When will the payment be received?

The IRS has announced that this stimulus payment has started being issued from August 15, 2025. Those who have the facility of direct deposit are getting the payment first. On the other hand, those who only get the check through the mail may have to wait a bit.

The IRS has said that most eligible applicants will get the payment by the end of August. If your payment has not arrived even after this, then you have to contact the IRS.

Where to contact for assistance?

In case you get into trouble during this process, help can be availed by the following options:

- IRS toll free: 1-800-829 1040

- Authorized site: www.irs.gov

- Nearest Tax Assistance Center (TAC)

Conclusion:

The amount of $5,000 is very important for any common family – whether it is rent, children’s education, ration or medical expenses. This step of the government is definitely a big relief. But at the same time, it is equally important to claim it correctly, provide the right information and avoid scams This payment can not only improve your current financial condition, but can also become a strong foundation for the future. Especially at a time when every dollar is valuable

FAQs

Q1. What is the $5,000 stimulus in August 2025?

A. The $5,000 stimulus is a financial relief program aimed at supporting eligible individuals and families in August 2025, likely introduced by the federal or state government.

Q2. Who is eligible to receive the $5,000 stimulus payment?

A. Eligibility may depend on income level, tax filing status, number of dependents, and whether you received previous stimulus checks. Exact criteria will be listed in the official government announcement.

Q3. Is the $5,000 stimulus payment available to everyone in the U.S.?

A. No, not everyone qualifies. The payment is typically targeted at low-to-middle-income households, certain benefit recipients, or individuals who meet specific requirements.

Q4. How can I apply or claim the $5,000 stimulus payment?

A. You may need to file a claim through the IRS, a government benefits portal, or an official stimulus application website. Some individuals might receive the payment automatically based on their tax return or government benefits enrollment.

Q5. Do I need to pay taxes on the $5,000 stimulus check?

A. Generally, stimulus payments are not considered taxable income. However, it is recommended to consult with a tax professional or IRS guidance.