$1,702 Payment Benefit? The year 2025 brings new hope and economic support to the people of Alaska. This year, the state government has issued $1,702 in stimulus checks, which are being distributed as part of the state’s Permanent Fund Dividend (PFD) program. While these are not traditional federal stimulus checks, they are no less important—especially at a time when inflation and rising fuel and energy prices have shaken the budgets of every household.

PFD program is a distinct program in Alaska that gives part of the oil and gas revenue of Alaska to its citizens. The article will make you know all the necessary information concerning the $1702 stimulus check 2025- eligibility, procedure of obtaining the check, payment timing, taxation laws, and how to spend the money in the most intelligent way.

What is $1702 stimulus check 2025?

The $1702 stimulus check for 2025 is actually the total payment of the Permanent Fund Dividend (PFD), which is divided into two parts—

- Base Dividend – $1403.83

- Energy Relief Payment – $298.17

Combined, it amounts to a total amount of $1702, which is given to every eligible resident. This payment is a tax-reportable amount that will count towards the US federal tax.

It is funded by the Alaska Permanent Fund, which is based on the state’s oil and gas revenues. It’s a way to distribute the earnings from Alaska’s natural resources more equitably among its citizens.

Key details of the 2025 PFD payment

- Total payment: $1,702 (1,403.83 + 298.17)

- Eligibility: All eligible Alaska residents

- Application period: June 1, 2025 to August 31, 2025

- Payment dates: June 20, July 17, August 15

- Payment method: Direct deposit or money order/check

- Tax status: Taxable at the federal level

- Official website: pfd.alaska.gov

The importance of these payments in 2025

Today, the effects of inflation can be felt in every household. The prices of food items, electricity and water bills, and especially fuel are constantly rising. This problem is even more serious in rural Alaska, where heating oil and food items are very expensive.

In such a situation, this payment of $1702 is a big relief for many families. This year an energy relief supplement has also been included in it, so that the burden of rising fuel costs can be reduced. This step shows that the government is committed to protecting its citizens from financial difficulties.

Who can get a stimulus check of $1702?

According to the Alaska Department of Revenue, you must meet these conditions for eligibility—

- Residence: It is necessary to live in Alaska for the entire year 2024.

- Intent: There must be an intention to live permanently in Alaska.

- Physical presence: It is necessary to live in Alaska for at least 72 hours in 2023 or 2024.

- Not claiming another residence: Must not have claimed residence in another state or country in 2024.

- Criminal record: Must not have a record of a felony or imprisonment in the eligibility year.

Acceptable Absences

If you were temporarily out of Alaska in 2024, you may still be eligible if your absence was for—

- Full-time college education

- Military service

- Medical treatment

- Living with a spouse or dependent for any of the above reasons

2025 payment dates

Payments are issued in batches based on the date your application was approved—

| Payment Date | Last Date for Application Approval |

|---|---|

| June 20, 2025 | June 12, 2025 |

| July 17, 2025 | July 9, 2025 |

| August 15, 2025 | August 7, 2025 |

It is important that your bank account details or mailing address are correct and up to date to receive payment on time.

How to apply?

Sources:- pfd.alaska.gov

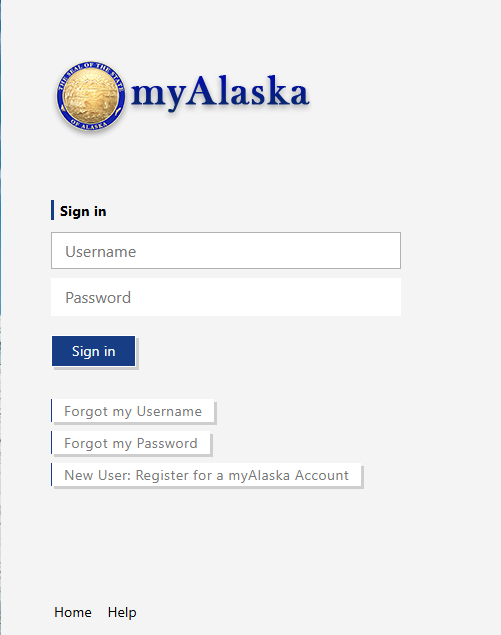

Sources:- myAlaska

The application is completely free and is done online only—

- Go to pfd.alaska.gov.

- Login with your myAlaska account or create a new account.

- Fill out the 2025 PFD application form.

- Upload the required documents (especially for dependent children).

- Choose the payment method – direct deposit or check.

- Submit the application before August 31, 2025.

Note: For children and dependents, a parent or guardian must apply.

What if you miss the deadline?

The deadline to apply is August 31, 2025. After that, late applications will be accepted only under the hardship exception. If you miss it, you will have to wait for the 2026 cycle, which begins on June 1, 2026.

Tax rules

This payment is taxable at the federal level. You will receive a 1099-MISC form in early 2026, which must be included in your tax return. The state of Alaska does not tax this payment, but the IRS does. This rule applies to children as well.

Alaska PFD vs. Federal Stimulus Check

| Parameter | Alaska PFD | Federal Stimulus |

|---|---|---|

| Source | Oil and gas revenue | Federal economic aid |

| Frequency | Every year | Occasionally in emergencies |

| Tax Status | Yes, federally taxable | Usually tax-free |

| Eligibility | Based on Alaska residency | Based on income and family size |

| Application | Required every year | Automatic in most cases |

How to use $1702 wisely?

Financial experts recommend using this payment wisely—

- Pay off credit card or loan debt

- Create or increase an emergency savings fund

- Buy energy-efficient appliances

- Spend on health, education or child care

- Invest in retirement savings

Many people follow the 50/30/20 rule—spend 50% on needs, 30% on wants and 20% on savings.

Effect on the economy

The PFD program not only helps individuals, but also boosts the local economy. In small towns, this money goes to shops, services and local markets, increasing employment and business.

However, some believe that a large portion of this fund should be spent on infrastructure, education and health services. At the same time, some people believe that the amount of the payment should be even higher in view of the rising cost of living.

Conclusion

The $1702 stimulus check 2025 is a significant relief for Alaska residents. It is not just a financial aid but a way to deliver the earnings from the state’s natural resources to the citizens. If you are eligible, make sure to apply on time and use this money wisely so that it can strengthen your financial future.

FAQs:

Q. Are the $1702 stimulus checks from the federal government?

A. No, they are part of Alaska’s Permanent Fund Dividend (PFD) program, funded by oil and gas revenues.

Q. Is the $1702 payment taxable?

A. Yes, it is federally taxable, and you will receive a 1099-MISC form.

Q. Who qualifies for the $1702 payment?

A. Alaska residents who meet the residency, intent, and absence rules set by the Department of Revenue.